Launching an offshore company in the UAE in 2025 offers international investors and entrepreneurs a strategic way to expand globally with ease and privacy. Whether you’re looking to protect assets, enjoy tax benefits, or expand internationally, the UAE offers a highly favorable environment. With well-regulated jurisdictions like RAK ICC and JAFZA Offshore, it’s now easier than ever to build a compliant, efficient offshore structure.

Why Set Up an Offshore Business in the UAE

Forming an offshore company in the UAE offers exceptional flexibility, confidentiality, and financial benefits for international business owners. The UAE’s offshore structure is designed to support international operations while offering a simplified setup process.

1. Key Advantages for Foreign Investors

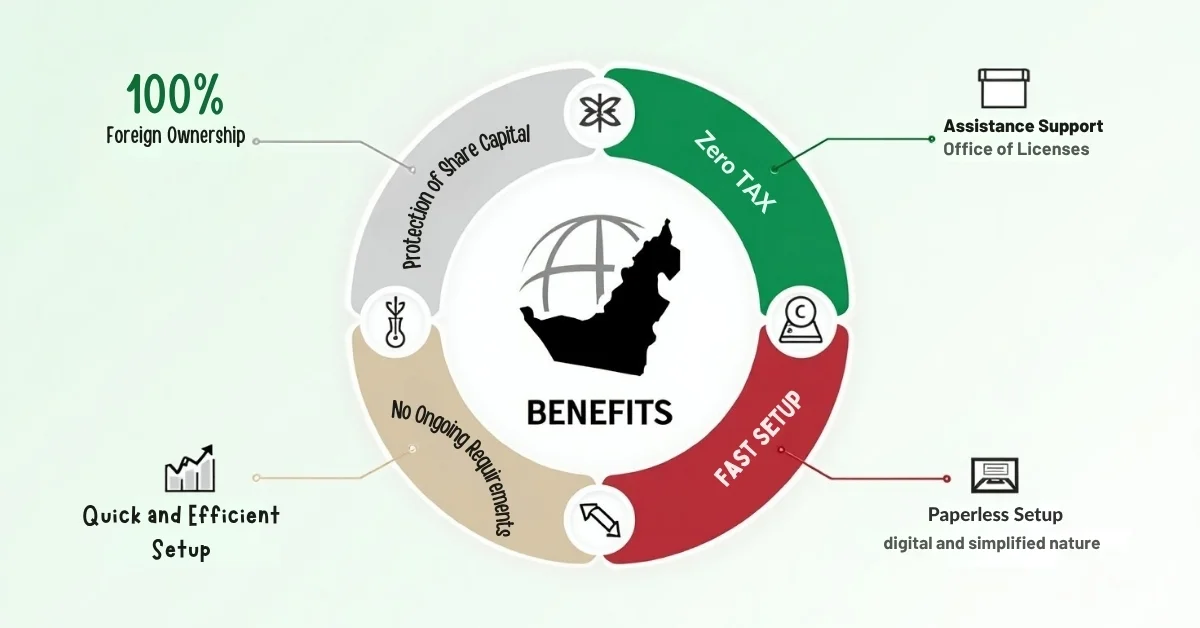

Offshore business owners enjoy several benefits that make the UAE a top destination for international company formation:

- 100% foreign ownership with no local sponsor needed

- Zero corporate and income tax, resulting in higher profit retention

- Privacy and asset protection, ensuring confidentiality of shareholder information

- No requirement for a physical office, reducing setup and operational costs

- Access to international markets and banking, with global credibility and strong financial infrastructure

2. Top Offshore Jurisdictions in the UAE

Choosing the right jurisdiction is the first step toward successful offshore business formation. The UAE offers several trusted zones:

|

Jurisdiction |

Key Features |

|

RAK ICC |

Flexible setup, low fees, fast registration |

|

JAFZA Offshore |

Close to ports, allowing UAE mainland company ownership |

|

Ajman Offshore |

Affordable option, ideal for holding or simple businesses |

Offshore Business Formation Process

Setting up an offshore company in the UAE follows a clear and efficient process. Most steps can be completed remotely with the help of a registered agent.

1. Step-by-Step Setup Process

1. Choose the Offshore Jurisdiction

The first step is selecting the right offshore jurisdiction that aligns with your business goals and operational needs. The UAE offers a few well-established offshore zones, such as RAK ICC, JAFZA Offshore, and Ajman Offshore. Each zone differs in terms of setup cost, regulatory flexibility, international reputation, and business scope. For instance, RAK ICC is known for its affordable packages and quick setup, while JAFZA Offshore allows partial access to the UAE mainland. Choosing the right jurisdiction sets the foundation for a successful and compliant offshore operation.

2. Select a Business Name and Get Approval

After selecting your preferred offshore jurisdiction, the next step is to choose a unique business name that meets the authority’s guidelines. The name must be unique and must comply with the naming rules set by the offshore authority. It cannot include restricted words like “bank” or “insurance” and must reflect the nature of your business. After selecting the name, submit it for approval to ensure it’s accepted by the jurisdiction before proceeding with the next steps.

3. Appoint a Registered Agent (Mandatory)

Appointing a registered agent is a legal requirement when forming an offshore company in the UAE. This agent is licensed by the jurisdiction to handle all communication and documentation on your behalf. They submit your application, manage compliance requirements, and provide a registered address for your business. The registered agent ensures that the entire setup process is smooth and legally compliant.

4. Submit Required Incorporation Documents

After appointing your agent, you must prepare and submit all required documents. These typically include passport copies of shareholders and directors, proof of residence, a completed application form, and, in some cases, a simple business plan. If the shareholder is a company, additional documents like the Certificate of Incorporation, Memorandum & Articles of Association, and board resolutions may be required. Your registered agent will guide you on the exact documentation needed based on your setup type and jurisdiction.

5. Receive Certificate of Incorporation

Once the offshore authority verifies and approves all submitted documents, it will issue your Certificate of Incorporation. The certificate confirms that your offshore business is formally established and legally allowed to operate within the UAE. In most cases, the certificate is issued within three to seven working days, depending on the jurisdiction and accuracy of your application.

6. Open a Corporate Bank Account

After incorporation, you can proceed to open a corporate bank account in the UAE or internationally. This step is essential for managing your company’s finances, receiving payments, and conducting international transactions. Most banks require the incorporation documents, shareholder IDs, and sometimes a personal interview or due diligence checks. Your registered agent can assist you in choosing the right bank based on your business type, account requirements, and preferred currency operations.

2. Required Documents for Setup

To complete your offshore formation, prepare the following:

- Valid passport copies of shareholders and directors

- Proof of residence, such as a utility bill or recent bank statement

- Business activity description, explaining the nature of your operations

- Shareholder resolution (if applicable) to define decision-making authority

- Memorandum and Articles of Association (MoA/AoA) outlining company structure and roles

What the Offshore License Allows and Restricts

Offshore licenses come with clear permissions and limitations:

- Passport Copy: Submit a valid passport copy (minimum 6-month validity) for each shareholder and director to confirm identity and nationality as per UAE offshore setup rules.

- Proof of Residence: Provide recent proof of address (utility bill or bank statement) showing name and address, not older than 3 months, to confirm residential status.

- Business Activity Description: Briefly describe your company’s planned operations, services, or products, ensuring they align with the allowed activities of the chosen offshore zone.

- Shareholder Resolution: If there are multiple shareholders, a resolution is needed to document agreed-upon decisions like appointing directors or authorized representatives.

- MoA & AoA: These essential legal documents outline how the company is organized, who is responsible for management, and the rules for its internal operations. They must be properly formatted and signed by all shareholders.

Is Offshore Setup Right for You?

Not every business fits the offshore model, but for many, it’s a highly efficient option. Here’s who benefits most from it.

1. Who Should Choose an Offshore Business?

- Entrepreneurs seeking tax efficiency and asset protection

- Global consultants or freelancers with international clients

- Holding companies and IP asset managers looking to separate ownership

- International traders and e-commerce firms targeting global markets

Set Up Your Offshore Business with LUKADAH

At LUKADAH, we specialize in seamless offshore business formation in the UAE. Our team handles the full process, from choosing the right jurisdiction to opening your bank account, ensuring your company is legally compliant, tax-efficient, and set for international growth.

📞 : +971 4 394 0800

📩 : info@lukadah.com

🌐 : www.lukadah.com

FAQ

1. How much time is required to establish an offshore company in the UAE?

Most offshore setups are completed within 3 to 7 working days, depending on the jurisdiction and the accuracy of submitted documents.

2. Do I need to be in the UAE to open an offshore company?

No, physical presence is not required. You can set up your offshore company remotely through a registered agent.

3. Can I open a bank account with an offshore company in the UAE?

Yes, offshore companies can open corporate bank accounts in the UAE or internationally. Some banks may require a physical visit or additional verification.

4. What types of activities are allowed for offshore companies?

Offshore businesses can engage in international trading, holding assets, consulting, and IP management. They are not permitted to conduct business directly within the UAE mainland market.

5. What is the main difference between offshore and free zone companies?

Offshore companies are ideal for global business activities and safeguarding assets, whereas free zone companies offer local operational benefits, including visa eligibility and office facilities.