Economic support in business is a key driver for entrepreneurs looking to thrive in one of the world’s fastest-growing economies. The UAE offers unmatched support through funding, tax relief, and strategic growth platforms. Entrepreneurs choose the UAE for its energetic, business-friendly environment that actively supports growth and long-term success. In recent years, the government has launched several significant initiatives to promote innovation, support small and medium-sized enterprises (SMEs), and foster long-term, sustainable growth.

Government Support Programs for Startups

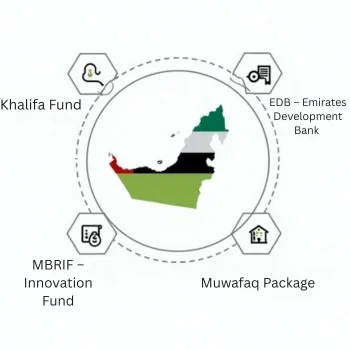

Initiatives such as the Muwafaq Package, Khalifa Fund, CSR UAE Fund, and the Mohammed Bin Rashid Innovation Fund play a crucial role in establishing a robust and supportive startup ecosystem in the UAE. These are supported by tech-forward institutions like the Dubai Future Foundation, which positions the UAE as a hub for innovation, collaboration, and business leadership.

1. SME Funding Options by UAE Authorities

- Khalifa Fund for Enterprise Development

- Mohammed Bin Rashid Innovation Fund (MBRIF)

- Emirates Development Bank (EDB) loans

- Muwafaq Package for SMEs by the Federal Tax Authority

2. Khalifa Fund for Enterprise Development

The Khalifa Fund is a government-backed initiative aimed at empowering UAE nationals to launch and grow small and medium enterprises (SMEs). Established in 2007, the fund provides interest-free or low-cost loans, along with business training, mentorship, and advisory services.

Its goal is to support innovative ideas, diversify the UAE economy, and reduce reliance on traditional sectors. The fund focuses on high-potential industries like technology, agriculture, manufacturing, and services, helping entrepreneurs build sustainable, homegrown businesses.

Overall, the Khalifa Fund acts as both a financial and developmental partner, ensuring that entrepreneurs are not only funded but also guided toward long-term success.

3. Mohammed Bin Rashid Innovation Fund (MBRIF)

The MBRIF is a flagship UAE initiative with an AED 2 billion fund, launched to empower high-potential innovators and strengthen the country’s position as a knowledge-driven economy. MBRIF supports entrepreneurs through two main avenues:

1. Loan Guarantees, Not Equity

Instead of taking ownership stakes, MBRIF backs innovative businesses by guaranteeing bank loans, reducing financial risk for lenders. If the startup struggles, the government steps in to make credit more accessible and affordable.

2. Innovation Accelerator

This non-financial arm provides tailored support, including mentorship, business strategy coaching, market connections, and hiring guidance. It’s designed to help startups scale rapidly without diluting equity.

Ideal for: Businesses with innovative solutions in priority sectors like healthcare, technology, renewable energy, transportation, water, education, and space, especially those ready to commercialize and scale.

4. Emirates Development Bank (EDB) Loans

Established in 2015, Emirates Development Bank (EDB) drives industrial growth and supports the UAE’s economic diversification goals. It offers tailored loans across priority sectors, manufacturing, healthcare, food security, advanced technology, infrastructure, and renewables

1. What Makes EDB Stand Out:

- Fast Loan Approvals: SMEs can access up to AED 5 million via a fully digital banking app, with decisions made in as little as five days

- Flexible Offerings: Includes working capital, capital expenditure, asset-backed and agritech financing, along with green and digitization funding

- Credit Guarantee Partnerships: Through collaborations with commercial banks like ADCB, CBI, and Emirates Islamic, EDB can cover up to 50% of loan risk, allowing smaller businesses better access to credit

- Advisory Support: Beyond funding, EDB offers guidance on financial planning, operations, market analysis, and matching with incubators, helping startups refine strategy and execution.

5. Muwafaq Package: Simplifying Tax for Entrepreneurs

The UAE government launched the Muwafaq Package to help entrepreneurs and SMEs manage their tax obligations more effectively and with less complexity. Launched by the Federal Tax Authority (FTA), it focuses on removing the common financial and compliance barriers that startups face.

Benefits for Entrepreneurs:

- Personalized Support from the FTA: SMEs receive personalized tax assistance through dedicated relationship managers appointed by the Federal Tax Authority (FTA) to ensure faster and more efficient support.

- Affordable Tools: Discounted accounting and VAT software tailored for small businesses, reducing setup and operational costs.

- Educational Resources: Regular workshops and learning materials to help founders understand tax rules and avoid penalties.

- Priority Services: Faster processing and priority access to FTA services, improving efficiency in compliance tasks.

- Cost-Saving Offers: Exclusive discounts on professional tax agent services to lower ongoing compliance expenses.

Overall, the Muwafaq Package empowers entrepreneurs to stay compliant with less stress while focusing more on growing their business.

6. Eligibility Criteria for the Muwafaq Package

To qualify for the Muwafaq Package, a business must:

- Be a registered SME operating in the UAE

- Hold a valid Tax Registration Number (TRN) from the FTA

- Be active and compliant with UAE tax regulations

- Fall within the official SME classification based on revenue and employee count

7. Application Process for the Muwafaq Package

The application process for the Muwafaq Package is simple and fully digital. Eligible SMEs can apply through the Federal Tax Authority’s official platform.

The process involves:

- Logging in with your TRN credentials

- Submitting basic business details

- Requesting access to Muwafaq support services

Once submitted, the FTA reviews the request and connects approved businesses with the relevant benefits and support channels. No lengthy paperwork, just a streamlined process focused on making tax compliance easier.

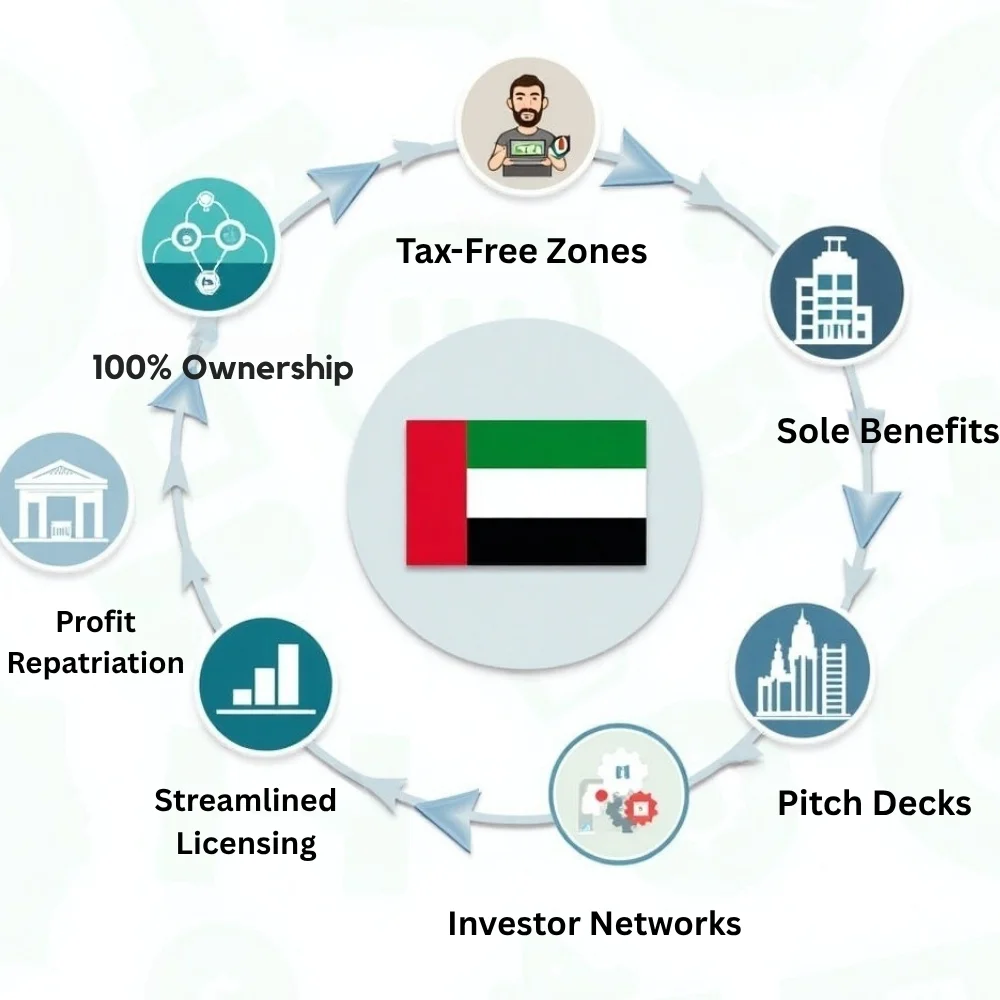

Financial and Tax Benefits for Startups

The UAE’s tax system is designed to attract and retain startups by minimizing financial stress. The UAE’s free zones are one of the biggest advantages for entrepreneurs looking to start or grow a business. These designated areas offer a range of financial and regulatory incentives designed to attract investment and support business growth.

- 100% foreign ownership and full profit repatriation

- Zero personal income tax and reduced operational hurdles

- Sector-specific zones catering to media, fintech, logistics, and trade

From a tax perspective, free zone companies benefit from corporate tax exemptions for a specified period (often 15–50 years), making them highly attractive for startups and international investors. Many free zones also offer streamlined licensing, faster registration, and sector-specific support, such as tech, media, logistics, and healthcare.

Overall, setting up in a UAE free zone offers a cost-effective and business-friendly environment, especially for entrepreneurs seeking long-term tax and operational benefits.

Access to Investor Networks

One of the key advantages of building a business in the UAE is the ease of connecting with active investor communities. The country has developed a strong ecosystem where startups can find funding, mentorship, and long-term strategic partners.

Entrepreneurs benefit from fundraising platforms and networks such as:

- DIFC FinTech Hive

- Hub71

- Regular pitch events, incubator demo days, and private investor circles

These platforms are designed to help startups gain visibility and access to venture capitalists, angel investors, and institutional backers. Whether you’re an early-stage founder or a scaling startup, these networks offer opportunities to secure investment and build valuable relationships within the UAE’s thriving business landscape.

Infrastructure and Digital Economy Boost

The UAE has made major investments in infrastructure and digital transformation to support business growth. With world-class transport, logistics, and high-speed connectivity, entrepreneurs benefit from a reliable environment to operate and scale.

Government-led initiatives in AI, blockchain, and smart services further enhance the digital economy, making it easier for startups to innovate, automate, and compete globally.

1. Digital Tools for Fast Business Setup

Entrepreneurs can now register, manage, and scale businesses entirely online through:

- MoIAT, DED, and TAMM e-platforms

- eLicensing systems for fast approvals

- Integrated dashboards to manage taxes, renewals, and permissions

2. Smart City and Tech Ecosystem

The country’s broader vision of becoming a tech leader supports startups in emerging fields. Innovation-focused platforms include:

- Dubai Future Foundation (DFF) is a hub connecting startups with corporates and government entities to solve real-world challenges

- Mohammed Bin Rashid Innovation Fund (MBRIF) is a government-backed program offering credit guarantees, mentoring, and business acceleration

DFF’s five business units include Future Foresight, Innovation Acceleration, Capacity Building, and Experience Labs, all focused on building an innovation-driven future.

Long-Term Business Growth and Scalability

The UAE provides a strong foundation for entrepreneurs to not only launch but also scale their businesses sustainably. With access to modern infrastructure, global markets, and supportive government policies, startups can expand operations with confidence.

Free zone flexibility, access to funding, talent availability, and digital transformation initiatives all contribute to creating an environment where businesses can grow steadily and compete on a global level. Once a business is launched, these initiatives help ensure it can grow and scale effectively.

1. Support for Scaling and Expansion

Founders benefit from:

- Flexible trade licenses for regional and international expansion

- Access to global logistics networks like JAFZA

- Entrepreneurs, investors, and skilled professionals can qualify for the UAE’s Golden Visa as recognition for driving the country’s economic development.

These advantages provide startups with a clear path toward long-term success in and beyond the UAE.

2. Tracking Business Performance

Growth without direction can lead to failure. That’s why entrepreneurs must monitor their performance using key business metrics.

Common startup KPIs include:

- Cash Flow: Ensures you always have capital to run operations

- Customer Acquisition Cost (CAC): Shows the total amount a business spends to gain a new customer.

- Customer Lifetime Value (LTV): Estimates how much revenue a customer brings over time

- Net Profit Margin: Reflects your business’s profitability after expenses

Moreover, training workshops and government-supported bootcamps help entrepreneurs learn how to use these metrics to plan for smart, strategic growth. This data-driven approach equips founders with the clarity they need to make informed choices, secure funding, and enter new markets.

How Lukadah Helps Entrepreneurs in the UAE?

Set up your business as an entrepreneur in the UAE with Lukadah, your trusted one-stop consultancy for launching and growing a successful venture in Dubai. We specialize in business setup, investor visas, corporate bank accounts, tax registration, accounting, audits, and virtual CFO services. Lukadah supports solo founders and growing teams with clear pricing, expert advice, and tailored strategies covering everything from setup to scaling. Located at Cloud Spaces, Downtown Dubai, we’re here to simplify your journey. Book your free consultation today and take the first confident step in your entrepreneurial path.